This is an Insurance policy which provides cover for the construction/erection of machinery, plant & steel structures involving very little civil engineering works against following unforeseen sudden physical losses:

It covers losses during the testing and commissioning prior to hand-over and damage during the contractual maintenance period.

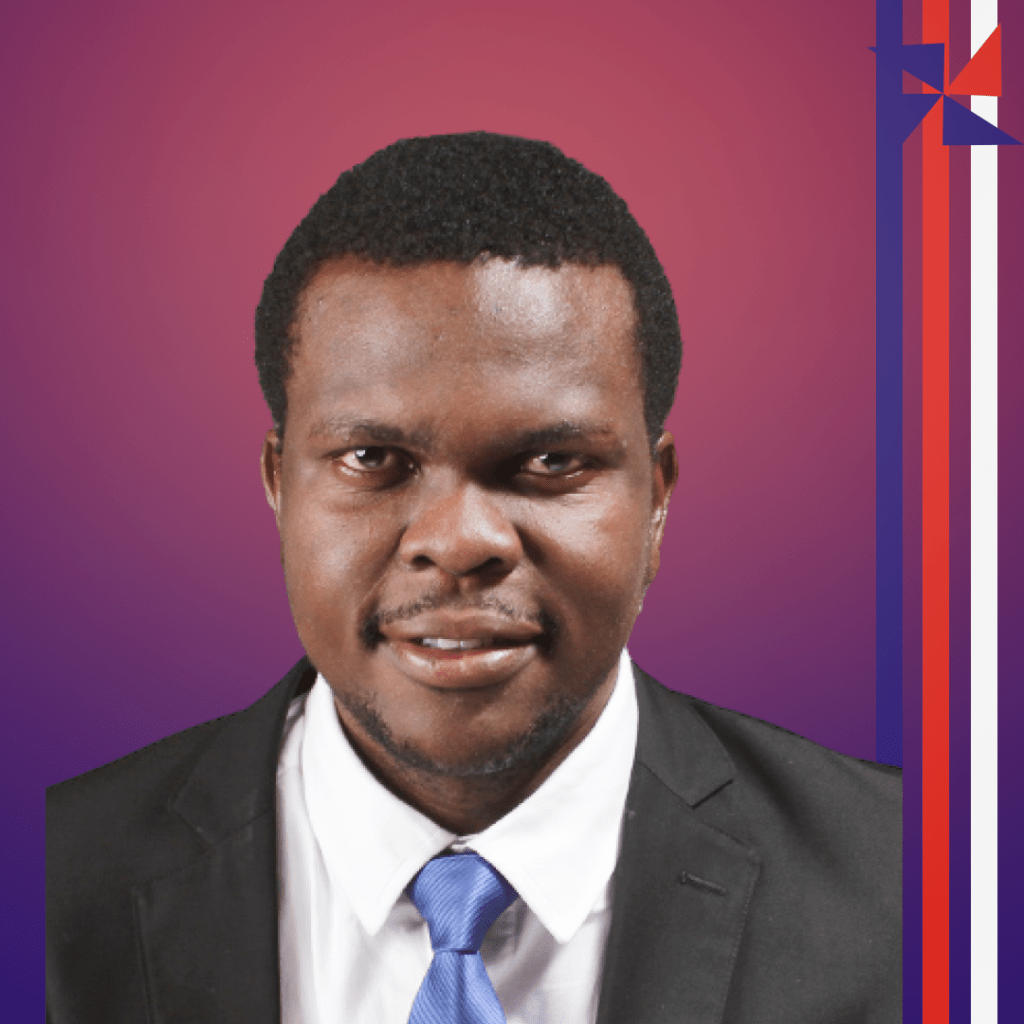

Account and Finance

Adenle Emmanuel Olalekan is an Accounting Graduate from Ekiti State University. He began his career in the insurance industry when he joined Risk Analyst Insurance Brokers Ltd.

He is presently in our underwriting and claims unit. He advises clients on the appropriate insurance policy to take care of their various risk exposures, negotiate appropriate premiums and appropriate risk coverage, preparing and maintaining documentation on all client portfolio and preparation of insurance reports on client’s portfolio.

He is also in charge of claims management on behalf of clients; providing advice on making a claim and the processes involved, collecting accurate information and documents to proceed with a claim, handling any complaints associated with a claim and ensuring fair settlement of a valid claim within the shortest time possible.

Emmanuel is involved in the marketing of insurance products to both new and existing clients.

Technical Officer, Uderwriting

Olayemi Obafuwa is a Mathematics Graduate from the Federal University of Agriculture Abeokuta, before he joined Risk Analyst Insurance Brokers, he worked with Obalufon Grammar School, Sepeteri, Oyo State during his service year.

He advises clients on the appropriate insurance policy to take care of their various risk exposures, negotiate appropriate premiums and appropriate risk coverage, prepare and maintain documentation on all client portfolios, and preparation of insurance reports on clients’ portfolios.

He is also in charge of claims management on behalf of clients; providing advice on making a claim and the processes involved, collecting accurate information and documents to proceed with a claim, handling any complaints associated with a claim and ensuring fair settlement of a valid claim within the shortest time possible.

AGM (Business Development & Client Services)

Maureen is a Graduate from University of Benin and has a Master of Business administration (MBA) from the same school. She became Chartered member of Chartered Insurance Institute of Nigeria (ACIIN). She has well over 18 year of corporate experience spanning through strategic planning, Customer services Marketing and Business Development.

Maureen has worked in different Marketing and Managerial Capacity in various financial institutions and specifically in the insurance Industry since April 1999. She has been involved in developing training schedule for corporate clients in sync with their corporate improvement and developmental plan.

She has experience in various aspect of insurance which include Customer service, Marketing and capacity development. Maureen who is an effective and erudite speaker has facilitated various training programs. She is presently involved in capacity development for women in business and career. Since she joined Risk Analyst Insurance Broker Limited in December 2017, Maureen has been very innovative in terms of Business Development and better ways of servicing clients.

Maureen oversees the client’s services operations of all the units which include both Underwriting and claims, Engineering, Special Risk, Life Insurance etc. She is directly involved in day to day relationship management the company’s major clients.

Maureen has attended several training, Programmes, Conferences and seminars on Insurance, marketing, Customer relationship management and capacity development.